With President Biden’s veto on overturning a retirement investment rule that would take into account the impact of climate change and other environmental, social, and governance (ESG) factors, let’s talk about your emotions that may lead you to invest in or not invest in certain stocks like ESG, sin stocks, big oil, or big companies. And look at data to see if your emotions may prevent you from making bigger investment gains.

Ethical or Anti-ESG Investing

There is a whole group stocks, index funds, and mutual funds that focus on a certain group of stocks that are meant to make the investor feel good about investing in. There is ESG or ethical stocks that only invest in companies that meet ESG guidelines. Then there are anti-ESG stocks which are companies that don’t have any ESG guidelines. Sin stocks are normally classified as alcohol, tobacco, gambling, and maybe firearms companies. Some investors don’t want to invest in big oil due to environmental concerns, big tobacco due to smoking deaths, or big pharma due to the opioid crisis.

For many people, their feelings may steer them to these types of stock groups. Remember, the main reason to invest is to maximize gain, right? So strict utility thinking, it doesn’t matter what the company does or does not do if they can maximize the gain on your investment. But as we continue discussing, feeling and emotions get in the way of our investment choices.

Data on ESG, sin stocks, or ethical investing

If you can put your feelings aside from what the companies produce, what does the data show on these types of investments vs. just normal investments? We will start with ESG stocks.

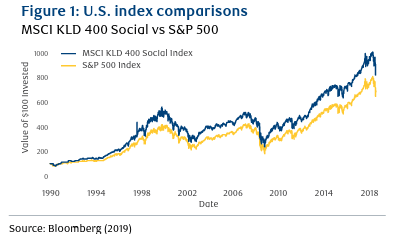

RBC Global Asset Management report, “Does socially responsible investing hurt investment returns?” indicated that ESG investing returns are similar to S&P500 returns but in the 2010s ESG stock did better. A comparison chart is shown below:

As you can see from the chart, ESG and S&P500 stocks, have correlated very well since 1990. Let’s look at some other data from Charles Schwab.

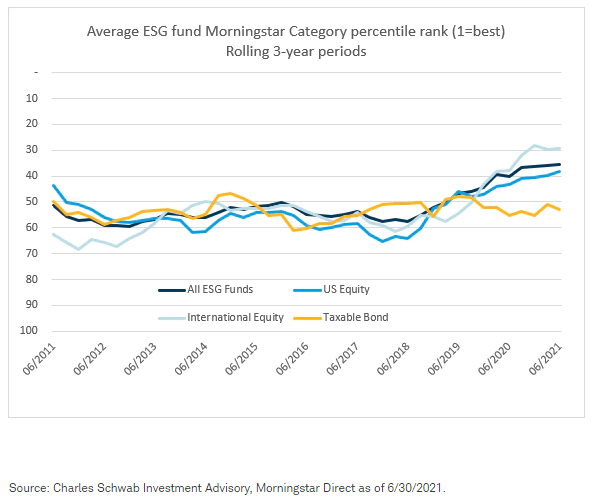

Charles Schwab using Morningstar data, has more recent information on ESG funds vs. U.S. Equity, International Equity, and Taxable Bonds. Their data shows that ESG funds do just as well as other stock groups, and in some periods from 2019 to 2021, ESG funds beat U.S. Equity but trailed International stocks.

Now let’s compare these ESG stocks with a “sin stock” index and S&P500. Luckily, Four Pillar Freedom has done that for us. Here is their comparison chart. They removed 2018 because sin stocks were hammered that year, so it may be more of an anomaly.

So they looked at $10,000 invested in S&P500, iShares MSCI KLD 400 Social ETF (DSI), and USA Mutuals Vice Fund Investor Class Shares (VICEX); gotta love the ticker symbol. As you can see, the differences in returns were similar until 2013 and on when the sin stocks performed worse.

Emotional Investing: Good or Bad?

When you look at the data from the 2010s, you cannot conclude that investing with your heart or feelings leads to better or worse outcomes alone. There are times when regulation might hit one sector more than another, i.e. more states allow online gambling or the federal government bans vaping products.

Advice is to look at the whole economy, the stocks, index funds, or mutual funds themselves, compare them to other types of funds, and then invest where you can stomach the types of stocks. The best advice is to spend less on trading costs and index or mutual fund expenses, and then you will gain higher returns.

As for President Biden’s veto, the fight is really about political gain, not truly investment gain, because you can get great returns on ESG, sin, or S&P500. Also, remember that ESG or sin funds would not exist if the returns were not comparable to other offerings out there; no one would put money into these funds.

.