Anchoring Bias

Tendency to rely heavily on a historical reference point or one piece of information.

Call Option

An option to buy a stock at a specific price in the future, no matter the current stock price

Cognitive Dissonance

Your brain is struggling with two opposite ideas, causing you psychological pain. People will ignore, reject, or minimize information that conflicts with their positive self-image.

Commitment Bias

After you have committed to an action, you tend to continue with that action, even though there are undesirable outcomes. This bias is stronger if the commitment is public.

Confirmation Bias

Seeking or over-emphasizing information conforming to your current beliefs and disregarding conflicting information.

Disposition Effect

Tendency to sell winners and keep losers; i.e., sell winning stocks but keep losing stocks. This is tied to pride in choosing winners and regret in choosing losers.

Endowment Effect

The endowment effect is when people demand more to sell an object than they would be willing to buy.

Familiarity bias

The tendency to prefer things that are familiar to them even if it is not the best choice

Herd Behavior

Tendency to follow the crowd as you feel safer than making a decision on your own.

House Money Effect

After people have experienced a financial gain or profit, they tend to be riskier in investing. They feel they are playing with “house money” as they say in gambling.

Illusion of Control

The belief you have influence over uncontrollable events due to a choice, past success, information, active involvement, task familiarity, and outcome sequence

In the Money

In referring to options, In-the-money (ITM) means that for a call option, the strike price is lower than the current price, and for a put option, the strike price is higher than the current price, so your options have a profit at this point in time.

Long Straddle

An options strategy is used when you feel a stock will move dramatically one way or the other but don’t know which way, so you purchase a call option and a put option at the same strike price.

Loss Aversion Bias

Tendency to avoid the psychological pain of loss because it is twice as powerful emotionally as acquiring gains.

Mental Accounting

Treating money differently depending on how it was acquired.

Overconfidence Bias

Tendency to see ourselves better than we really are.

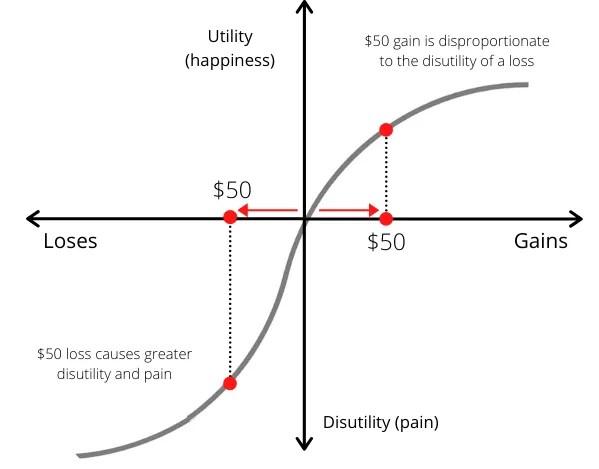

Prospect Theory

Prospect theory is the way people frame an uncertain decision. They look at the decision in terms of gains and losses. However, losses cause much more emotional pain than equivalent gains. This chart shows how the same amount of loss is twice as emotionally painful as the same amount of gain; i.e., losing $50 feels much worse than gaining $50 in feeling better.

Out of the Money

In referring to options, out-of-the-money (OTM) means that for a call option, the strike price is higher than the current price, and for a put option, the strike price is lower than the current price, so your options are worthless at this point in time.

Put Option

An option to sell a stock at a specific price in the future, no matter the current stock price.

Risk Aversion or Snake Bite Effect

After experiencing a financial loss, some people tend to be less risky. They feel they are unlucky and may continue to be unlucky.

Status Quo Bias

A tendency to keep what they have than exchange it.

Strike Price

In options trading, the strike price is the price you can exercise, not the price you paid for the option itself. For example, if you bought a call option (option to buy) for $0.25 at a strike price of $5 and the current underlying stock price is $6, then you can exercise this option and make a $1 profit per share minus the $0.25 cost of the option.

Sunk Cost Effect

Consideration of non-recoverable costs, time, or resources in deciding the future.

Try to Break Even Effect

After experiencing a financial loss, some people jump at the chance to make up their losses with riskier investments.