When you speak to most financial advisors and investment professionals, they say invest with your head and not your heart. Unless you can separate your head from your heart, this is impossible. Think about how many decisions we make in life that are not entirely rational, even when we think they are rational.

Buying a car

Let’s take an easy example of buying a car. To be entirely rational, you need a car to get you from point A to point B in a certain amount of time, nothing else. You need a motor, four wheels, a fuel tank or battery, a seat, a steering wheel, and a brake. Would this work? This may fit all your needs, but unless you are self-confident and cool like this guy, you may want more.

Then you start thinking, well, I need more space for groceries and for other people. I also want more safety features and to be a bit faster than this electric cart. We are still adding more rational needs to this car. Now you are thinking of maybe something more like a car.

You may look at this car and say, well, people will think less of me if I drive this car. I want to show people I’m cool, have style, and am rich. I also don’t like the look of this car; too boxy, the paint job is horrible, it has no hub caps, it does not comfortable, and look at the RUST! I want something nicer. Now, you have moved from a rational to a more emotional decision. Even though your goal is to get from point A to point B in a certain amount of time, you now want to do it in style. You really want a Tesla.

Your car buying decision is now more want than a need. When you open those side doors, you hope everyone will look at you and say, “Wow, they have a cool car and must be doing well. I want to be like them.” You want people to be jealous of your car choice. This is an emotional choice, not a rational choice. Sure, you can probably justify this purchase. I want to save the environment. This provides me with lots of room for friends and family. When I merge on the freeway, I have the speed to not get in an accident. This has the latest safety features. When the doors open, they won’t slam back on me when I get out; I hate that.

Buying a stock

You might say that is a poor example because investing does not involve how people view me or my decisions. But that is not true. Let’s say you have $1000 to invest in a stock. You have the following choices, and all have the same risk:

- Large gun and ammunition manufacturer with an annual return of 35%

- Sustainable agriculture food product company with an annual return of 25%

- Big tobacco and vaping company with an annual return of 40%

Remember the goal of investing is to get the maximum return for the minimal amount of risk. So if you only have these three choices, the most obvious is investing in big tobacco and vaping company, right?

What if you have children in high school with a vaping problem or a father who died from lung cancer due to smoking? Then you might make a different choice. You go with the gun and ammunition manufacturer. But wait again, you have seen all the reports of mass shootings and that has affected you deeply. In good conscience, you cannot invest in gun manufacturers.

You might also think you cannot talk socially about your great investments to friends if you invested in tobacco, vaping, guns, and ammunition. Depending on your friends, they might not understand or shame you because of your investments.

So you choose to invest in a sustainable agriculture food product company. Because of your emotions, you have decided to give up 10-15% profit or $100-$150 per year. This is a week of groceries for two people. This is not a rational decision. This decision may make your sleep better at night and allow you to talk to friends about this cool sustainable agricultural food product company.

Some of you would make the decision to forgo profits to invest in socially responsible (SR) stocks but remember this is an emotional decision, no matter how you justify it.

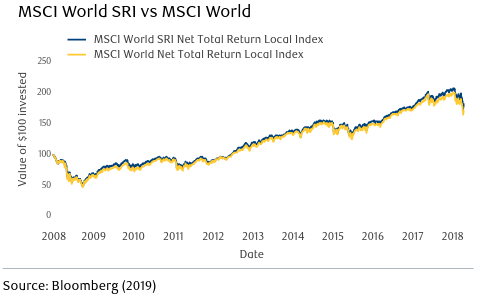

But in the real world, does this matter? Here is a report by RBC Global Asset Management that says socially responsible investing (SRI) has no impact on returns.

“The chief finding of this research is that socially responsible investing does not result in lower investment returns.”

RBC Global Asset Management, March 2019

So you can have a clear conscience and get the same returns, but remember that your choice of SR stocks is emotional.