I have invested in poorly managed companies or companies that have never made money, but I made a great return on them. And there are good companies that make great investments. It comes down to risk and reward, risk tolerance, and is your focus on short-term or long-term goals. Let’s first define what a good company is.

Good Companies

When I think of good companies, I think of good management, stable returns, profitable, a good market, and high customer satisfaction. Some companies that come to mind are Apple, Nike, GE, Disney, Starbucks, and Zappos. These all are big enterprises, they are profitable, people emotionally love them, and most analysts say they have great management. Ask any person if they think these are good companies to invest in, and most would say, Yes. My question is, why do people say Yes? They heard of these companies, they bought from these companies, and they hear they have great management, so they must be good investments, right?

Representative Bias

Because our brain has way too many things to consider, even when we try to focus on one task, our brain makes shortcuts. One of those shortcuts is the assumption that things with similar qualities are alike and those with different qualities are not alike. This is called representative bias or judging something new from a stereotype.

In the book “The Psychology of Investing” by John R. Nofsinger, he give a very good example of representative bias. Here is the story. Consider this question:

Mary is quiet, studious, and concerned about social issues. While an undergraduate at Berkeley, she majored in English literature and environmental studies. Given this information, indicate which of the following three cases is most probable?

A. Mary is a librarian

B. Mary is a librarian and a member of the Sierra Club

C. Mary works in the banking industry

Mr. Nofsinger has run this in this MBA graduate classes and there is the average breakdown of the answers:

- 25-33%% chose answer A

- 50-65% chose answer B

- 10-25% chose answer C

So most chose answer B because being studious and concerned with social issues probably means she is a librarian and a member of the Sierra Club. However, the question asked was “What was the most PROBABLE answer” not the answer that would make Mary happiest. Answer B is really a subset of answer A, so if you chose answer A, it is more probable than answer B. The right answer is answer C. Why?

There are approximately 86,000 librarians in the U.S., while there are 1.95M employees in the banking industry. Where is more likely or more probable for Mary to work? The banking industry, just because of the sheer size of employment.

In this example, your brain took the information, created a shortcut to an answer, and stereotyped Mary. She is a librarian and Sierra Club member. Never thinking that the chances are slim that she could find work as a librarian. Representative bias created a shortcut for you.

Representative bias in investing

Let’s get back to the good company does not make a good investment idea. A corollary to this idea is that past performance does not equate to future performance. A good company cannot grow forever, and a bad company may not perform poorly forever.

Let’s talk about a stock and product that I love, Tivo. I was one of the first owners of the Tivo product, Series 1, and I won it by writing an essay on why I should own a Tivo. I wrote about how when I was a small child watching Sesame Street, I would have accidents because I didn’t want to miss the live TV show, but now with Tivo, I could pause the show and go to the bathroom. I still have my Tivo plush.

Anyway, I loved the product, so I started to study their stock. They didn’t make money, but they had great intellectual property and patents. They mostly made money by suing everyone who was copying their features. So selling hardware and software in a countertop box was not that profitable if you didn’t have content or could work with the content providers or distributors, i.e., cable companies, networks, satellite companies, etc.

When you look at Tivo’s average annual stock price with their revenues, the stock price does seem to track reasonably well with the revenues, except for the significant downturn in 2018-2019.

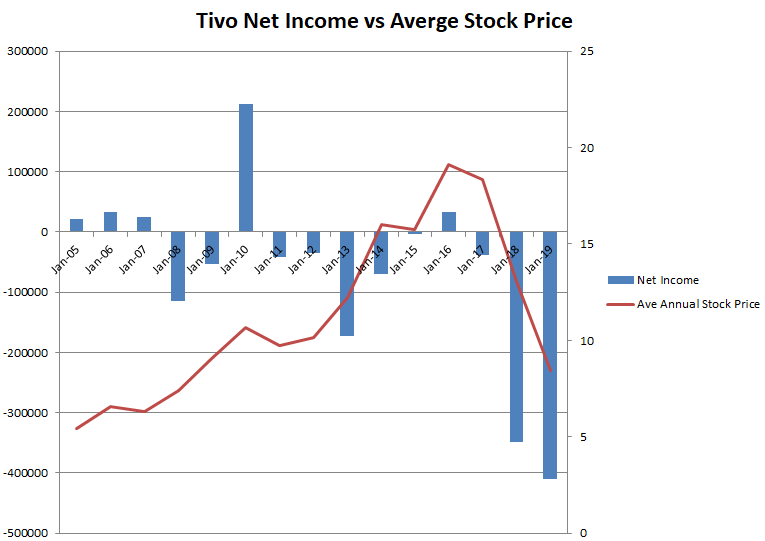

Now let’s look at the stock price vs their net income or profit.

Starting in 2005, they were making some profit, then in 2008 they had some losses, but the stock continued to go up. More losses from 2011 to 2014 but the stock continued to go up? Is this rational. Not until 2018 when they had huge losses, did the stock tank, but that was also due to the recession.

With these losses, you might not consider Tivo a good company; however, you could have made a lot of money on Tivo from 2005 to 2016, so I would consider this a good investment. I actually played the ups and downs of Tivo for years. As I discussed in my blog, “Option Trading Tip to Profit from Uncertainty,” I used the Tivo lawsuits as the uncertainty to buy, sell, or buy straddle options. If they won their suit, the stock price would normally go up as they have proven their patent was valid.

One thing Tivo had going for it was it was considered a growth tech company, and people wanted to invest in Tivo. At the time, you could have invested in other growth companies that might have been considered good companies.

Should I invest in bad companies?

There is no clear answer to that question. There are bad companies that will continue to be bad, with no clear route to profitability, i.e., Pets.com And they are good companies, like Zappos, that want to sell you shoes, sight unseen. No one at the time bought shoes without putting them on and walking around. But Zappos looked to Amazon and the cost savings from not having salespeople, retail stores, or distribution centers everywhere. They have done very well. Good company with good results.

The bottom line is don’t stereotype an investment because it looks like a good or bad company. Get rid of your representative bias and look more at what you think about their customer base, the size, what new ideas are working for the company, and whether are they quickly innovating.