If you believe in the efficient market theory (EMT), which states that the current stock price reflects all important information, whether known or unknown to the investor, then the only way to make money on the stock market is through speculation or buying on luck. This is the rational explanation of the market if everyone was always rational, which clearly everyone has emotional biases that skew their investment choices.

But suppose we take EMT as a given, we can look for ways to profit off uncertainty. Where does uncertainty come in for any company? Uncontrolled events like global pandemics, economic changes (recessions, inflation), political changes, and weather. Can we predict when these events will happen? Maybe you can predict a political change in the U.S. before an election but still now know what the results are, and you may have a 1-week prediction from a hurricane, but the path may change, and you don’t know the extent of the damage.

One interesting uncertainty I have personally profited from is the uncertainty of a trial against a company. Twelve men and women deciding on a billion-dollar case on a company. Do you actually know how they will decide? No, but you know approximately when the trial will end, which is a variable you can use. Here is how I have used this.

Long Straddle on Companies in Jury Trials

A long straddle strategy in options trading is buying a call and a put option on an underlying asset at the same or close to the same strike price. This options strategy is used when you feel a stock will move from its current price but don’t know if the stock will go up or go down.

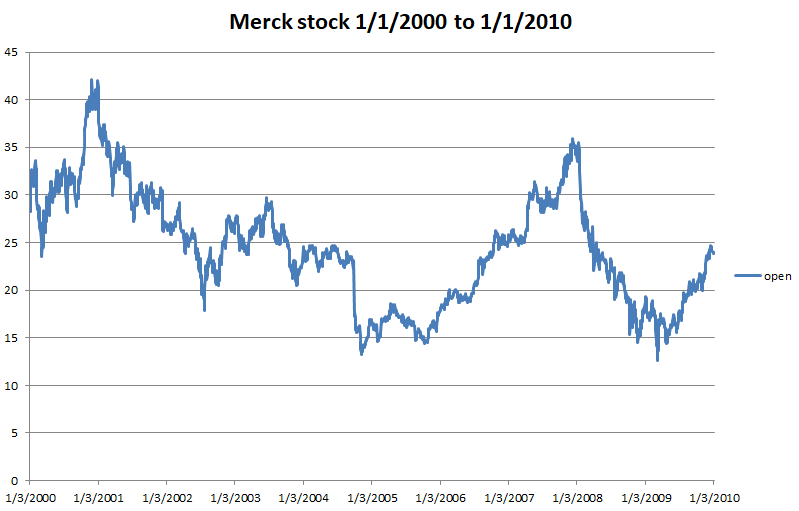

Let’s break this strategy down with an example. Suppose a big pharmacy company was hit with lawsuits that have gone to trial over an anti-inflammatory medicine that might cause heart attacks. Maybe the company was called Merck, and the medicine was called Vioxx. Here are the stock prices from Jan 1, 2000, to Jan 1, 2010.

Here are some of the lowlights on this stock due to Vioxx.

- September 30, 2004 – Merck pulls Vioxx from the market

- August 19, 2005 – Merck, if found negligent in a personal injury lawsuit in Texas, the first Vioxx lawsuit to go to trial. The court orders Merck to pay $24.5M in mental anguish and economic losses and $229M in punitive damages.

- November 9, 2007 – Merck announces paying $4.85 billion to end thousands of lawsuits over Vioxx.

Let’s focus on the first trial against Merck in August 2005. The stock has decreased a lot due to Vioxx being pulled from the market, but there may be more pain for Merck from these trials, or they may win, and the stock will go up. So you decided to do a long straddle on Merck on July 19, 2005, when the stock price was $17.09/share.

You buy 100 call options for early September 2005 for $1.00 per share with a strike price of $17.50, which is currently out of the money. You also buy a 100 put option for early September 2005 for $0.50 per share with a strike price of $17.00. You have spent $150 for those two options contracts, minus any trading fees.

Now August 19, 2005, arrives, and Merck loses the trial. The next day the stock drops from $16.27 to $14.70 per share. Your call options are worthless because you don’t want to buy Merck at $17.50 per share, so you may just keep it until the contract date expires. However, you put options are “In the Money,” and you can make a profit of $17.00 (strike price) – $14.70 (current price) = $2.30 per share, not counting the time value of the option. The put option price would probably be in the $3.00 range now.

You now have two choices. Sell the put option for $3.00 per share and make a profit of $300 (sold put option) – $150 (the price of buying a call and a put option) = $150, doubling your money.

WARNING: Before starting to trade options, learn and understand how they work. There are situations where you can lose a lot of money if you don’t trade options incorrectly. There can be situations where there are unlimited losses.