Let’s be honest. When investing, we all love to win and tell everyone what a great investor you are. You love to tell a story of how you found this stock put in $100, and then made $10,000. Of course, you don’t tell them the other story where you put in $100, and the stock rose to $5000. At that point, you felt it had to go higher and didn’t sell, then the stock dropped, but you still had hope it would go back up. Then the hope was dashed when the stock was delisted.

Yes, your emotions and behavioral biases affect how you manage your investments. Here are the top 5 emotions you need to control to be a better investor.

Pride

Pride in something we have done is a very good emotion, but when looking at investments where you are not actively affecting the stock price, pride can be detrimental to your profits. Suppose you have a new stock (Stock C) you want to buy but need to sell the $1000 in one of your old stocks to get the money. You have two choices to get the $1000:

- Stock A has a gain of 30%

- Stock B has a loss of 30%

Which stock would you choose to sell? Most people would sell Stock A because they want to “lock in their gains,” but the underlying emotional reason is that they want to feel pride in selling a winner. They made a great decision to buy Stock A. If they sell Stock B, then they actively confirm the loss and feel bad they bought Stock B in the first place. They may justify it by thinking that Stock B will surely go back up, so why sell it now?

Here are two reasons you should sell Stock B:

- Tax advantage in the U.S.

- High opportunity cost

To put this in number terms, let’s do that math for both Stock A and B. Assume a 20% capital gain tax.

- Taxes

- Stock A – To have a 30% gain, you purchased the stock at $769.23, so your taxable gain is $230.77, and the taxes would be $46.15. Net proceeds minus taxes are $1000-$46.15= $953.85.

- Stock B – To have a 30% loss, you purchased the stock at $1428.57, but now you only get $1000. Your loss is $428.57, which gives you a tax credit of $85.71. Net proceeds plus tax credit is $1085.71

- Future opportunity

- You should not look at Stock A’s or Stock B’s past results for future gains and opportunities. You need to independently analyze what is a better investment if you don’t own Stock A, Stock B, or new Stock C. Frame it this way. What two would you buy NOW if you have $2000 to invest in only two of three stocks? The past gain or loss does not matter as you are looking for the opportunity for future gains.

The rational answer without falling into the good feeling of pride is to keep Stock A, sell Stock B, and buy Stock C.

Regret

The opposite of pride is regret. Regret is the emotional pain of realizing a previous decision was a bad one. The key to regret in a financial situation is realization and action. People will not feel the full emotional impact of regret unless there is an associated action. Take the example above about Stock B. On paper, you have lost 30%, but if you don’t sell the stock, you have hope that it will rise back up. If you sell the stock, your action triggers your emotional pain of regret because you have finalized your loss. You said to yourself, that was a bad decision.

The problem with regret is that it makes people not want to sell losers when there are other better opportunities. You must realize your money is already lost, even if you don’t sell Stock B. You must focus on the here and now and look to the future. You cannot change your past decisions, but you can choose a better future.

Fear

Fear is one of the strongest emotions. It triggers the most base aspects of any animal or human, fight or flight. In stock investing, fear can cost you a lot of money or gain you more profit. In investing, fear can be measured by risk.

During a market downturn, people will see their investments drop and panic. Fear will set in. They may think, “Should I sell to keep what I have? Everyone seems to be selling?” Unlike our example of selling a losing stock to buy something better, selling is not the best solution if there is a full market downturn unless you need the money to cover other positions.

With fear, you can fall into the trap of selling low and buying high. It is time to hold tight in a market downturn and not let fear take over. In fact, a downturn is a good buying opportunity to lower your average cost per share, especially if the underlying company is not a going concern; i.e., it will not fail anytime soon.

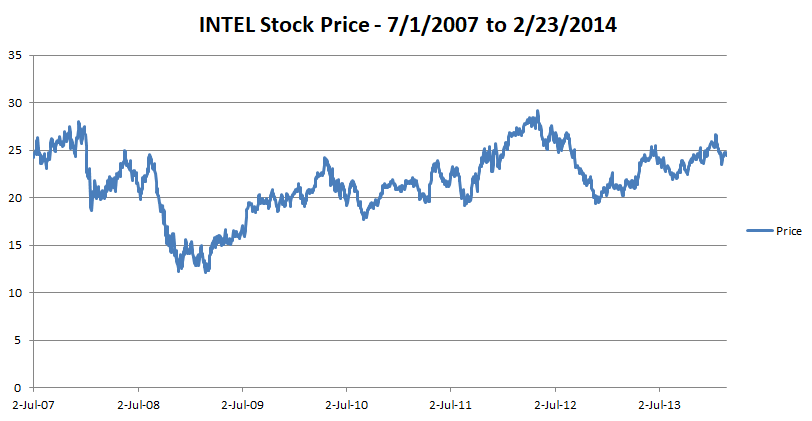

Suppose you purchased 100 shares of INTEL (INTC) at one of the highest prices between July 2007 and December 2009; that price would be $27.98 on Dec 6, 2007, a total of $2798. Then in 2008, the financial crisis hit. INTEL shares drop to a low of $12.08 on Feb 23, 2009, and you are down $1590! Fear would want you to sell as you are afraid it might go down farther. But, should you sell? Did INTEL as a company change in 14 months, and its markets drastically change where no one will buy computer chips in the future due to this downturn? The answer is NO.

So, you can sell on fear and lose $1590 – tax credit of $318 (20% rate) = a total loss of only $1272, keep the 100 shares or buy 100 shares more. Here is what happens after 1, 3, and 5 years of holding INTEL stock.

| Options | Position on Feb 23, 2009 | 1 year later | 3 years later | 5 years later |

| Sell 100 shares | $1526 (cash out+tax credit) | $0 | $0 | $0 |

| Keep 100 shares | $1208 | $2039 | $2666 | $2442 |

| Buy 100 shares more | $2416 | $4078 | $5332 | $4884 |

As you can see, the worst choice is selling in a downturn if the company is solid. In fact, you would want to put more money in to lower your average cost per share. On Feb 23, 2009, your average cost per share of INTEL was $23.98 because you bought at the high point. If you decided to purchase 100 more shares of INTEL on that date, you have lowered your average cost per share from $23.98 to $18.03.

Don’t let fear drive your decisions, especially in a downturn. Look at the company and see if the stock is going down due to a true structural shift in the economy; i.e., we don’t need computer chips anymore, or is this just herd mentality, where if everyone else is selling, we should sell too.

Greed

Do you believe what Gordon Gekko says in the movie Wall Street, “Greed is Good”? It can be a good thing to push people to take more risks in new technologies or services, but greed can hinder your profits for personal investing. Market bubbles are due to greed. People overvalue stocks or other investments because everyone else is doing the same and making money. When you see a stock go up, you start thinking, did I miss the boat? Should I buy into this stock now?

My question is, “Did you look at why the stock is going up?” Is it due to new innovations, new services, or an untapped market, i.e., real structural or business reasons the stock is going up? Or are you interested in buying the stock just because it is rising? This is how day traders operate, betting on momentum. Does this work? Absolutely…sometimes.

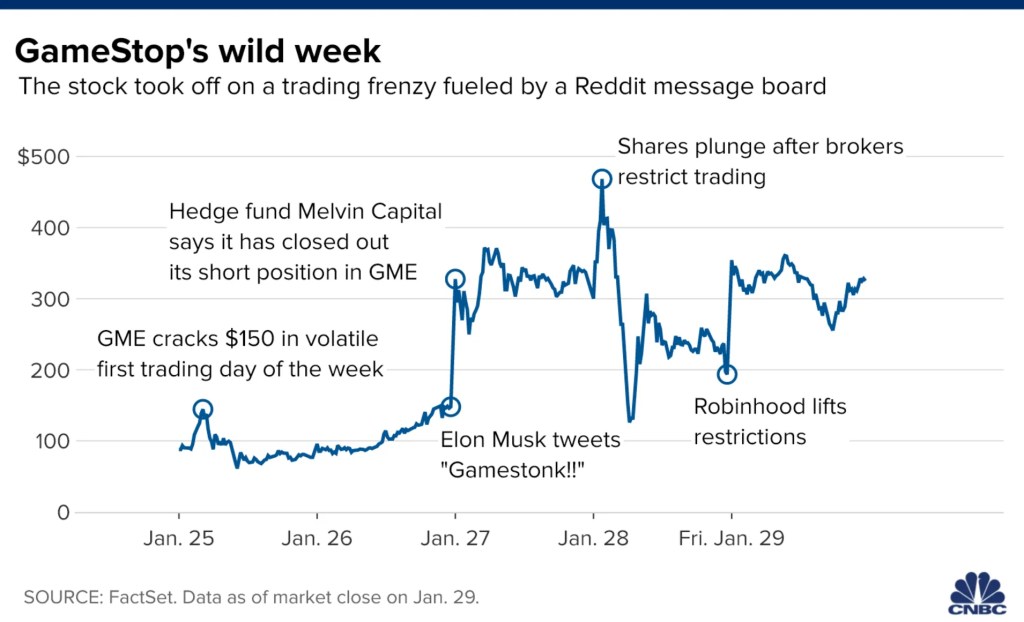

Let’s look at the craziness of Gamestop (GME) in January 2021. Here is a nice chart from CNBC on the craziest week in GME history. As a reminder, on January 4, 2021, the first day of stock trading 2021, the GME price was $4.31.

During this crazy change in stock price, the stock went as high are $483 per share, mostly due to the Reddit forum WallStreetBets which told its followers to buy GME. Eventually, the stock returned to the $10 range by early Feb 2021. So depending on when you bought and sold GME, you could have made 111X profit. Wow! In most of these bubbles, the traders who enter first win if they are not greedy and sell at a high point. Many, however, greedy traders bought during the run-up and then lost over 90% of the money when the price came crashing down.

Before this crazy run-up, the news was bad as several hedge funds bet on GME losing value. There were no structural market changes or a business change to GME’s business in January 2021, so there is no reason for the stock to rise, except for a group of Reddit forum members who told everyone to buy GME.

Don’t let greed allow you to make risky bets, especially if you can’t afford them. However, if you want to play the lottery and hope you win, just know that you are consciously making a risky bet.

We discussed how these four emotions can lead to poor investment decisions. There will be times when your bad decisions come out great. If you purchased GME at the bottom and sold a the top, you could have made a lot of money…in hindsight. During that time, you might have allowed greed to stop you from selling when it was 10X, 50X your investment. Or, when it dropped below your purchase price, you might have avoided regret, kept the stock, and lost more money. Be aware when your emotions are getting the best of you. Remember that luck is not skill, and overconfidence will eventually lead to losses.

One thought on “Top 4 Emotions to Control for Stock Investing”